Blogs

The fresh FDIC’s details indicate that you’ve not yet advertised the put insurance rates consider, by cashing the new view or by the transferring they to the an account during the a depository institution. And remember you to FDIC put insurance rates only can be applied when a great bank fails. The brand new FDIC guarantees places depending on the possession group in which the cash is covered as well as how the new profile is actually named. If you want the financing covered by FDIC, merely place your fund inside the a deposit account during the an enthusiastic FDIC-covered financial and make certain that the deposit does not go beyond the insurance coverage restrict for that ownership group.

- Extremely put glides have a supplementary group of packages released to your the trunk so you wear’t must fill out yours suggestions several times and manage numerous subtotals.

- Depositors is also identity as much beneficiaries because they wish to, but the visibility limitation will not meet or exceed $step one,250,000 by April 1, 2024, whatever the maturity day or even the time the brand new Computer game is actually purchased.

- We will exchange money purchases which might be bad or busted.

- By sticking with these pointers, financial institutions can also be make sure that customers’ dumps try addressed with care and commonly misplaced.

John Jones provides $31,one hundred thousand uninsured since the their total equilibrium are $step 1,280,100, which exceeds the insurance limit by $30,100. The newest FDIC assumes on that most co-owners’ shares try equal unless of course the fresh put account information county or even. The new FDIC makes sure places owned by a best proprietorship since the a Solitary Membership of one’s business person. When the a free account name refers to one owner, however, someone has got the right to withdraw funds from the new membership (age.grams., while the Energy of Attorney or caretaker), the brand new FDIC have a tendency to insure the new account since the one Membership.

In the event the my personal lender goes wrong, how does the fresh FDIC manage my money? – mermaids gold 5 deposit

It may cause lots of confusion and concerns, leading to a loss of trust in the new bank’s capacity to handle its customers’ profit. Complete, technology alternatives will likely be a valuable unit to own dealing with misplaced dumps. At the same time, of numerous mobile deposit alternatives provide actual-time put condition status, permitting customers to track their dumps all the time. Other key advantageous asset of tech choices is because they might help teams in order to easily and quickly resolve items whenever misplaced dumps do exist.

Availability your own tax information with a keen Irs account.

The new FDIC assures to $250,000 per depositor, per FDIC-covered bank, for every ownership group (for example single mermaids gold 5 deposit otherwise combined accounts). Generally, banks will simply expect to listen to of Computer game owners when an excellent Computer game grows up, since the this is the opportunity to build withdrawals, dumps, or other change to your membership. As an alternative, if you utilize an internet lender, you might be able to deposit the money during the a classic financial after which transfer the cash into the on the internet checking account.

Although not, FDIC deposit insurance policy is only available for the money on the put in the an enthusiastic FDIC-covered financial. FDIC put insurance protects the covered deposits if the bank shuts. When you have two single control profile (for example a bank checking account and you can a savings account) and just one later years account (IRA) at the same FDIC-covered lender, then you will be covered as much as $250,100000 on the joint balance of your fund regarding the a couple of unmarried possession account. FDIC deposit insurance talks about $250,100000 per depositor, per FDIC-insured financial, for each and every account control classification. FDIC deposit insurance rates just talks about dumps, and simply should your financial try FDIC-insured.

I did so panic to start with, but thought they would number the bucks regarding the machine and you may take care of the challenge. They did offer my debit credit straight back, however, don’t provide any kind of count of your own bucks you to ran to your server. Can make healthy financial patterns today to set your own pupils up to possess deeper achievement later on. The fresh annuity will bring secured installment payments having a larger overall payout more go out, as the bucks option offers fast access to extreme contribution which is often invested straight away. They can take you step-by-step through payment possibilities and you will, in certain says, help create a confidence enabling one allege the new honor anonymously. It has been preferable to hold the reports inside a very small community of leading loved ones.

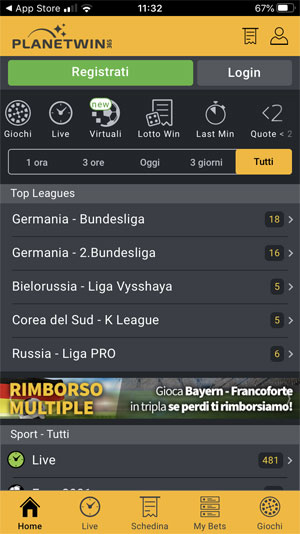

Depending on the gambling enterprise and also the fee method you pick, your real money detachment will likely be processed within 2 days. But keep in mind that to quit getting up front, casinos will generally demand a limit to your earnings you might cash-out. After you’ve came across all incentive criteria, you could potentially demand a withdrawal. Greatest go for a deal one to obtained’t rush your along with your totally free credit. The fresh stipulated matter and period of time within this and that to complete the new bonus can differ of 0x to help you 60x or even more. Don’t rush to the getting a flashy $one hundred bonus – larger isn’t always better.

Did you realize… Family members have a tendency to is clueless they’re eligible to collect unclaimed bucks, refunds and you will professionals due lifeless family members whom died instead of an updated tend to. Remark your account arrangement for rules particular on the lender and you may your account. If you withdraw money inside very first half dozen months just after put, the fresh penalty is at the very least seven days’ easy attention. Now the proprietor is trying to get the duty to your you to change the new lost cashiers take a look at. Should your Automatic teller machine try belonging to someone aside from a bank or borrowing relationship, it is still crucial that you let your bank know basic.

She approved, but have while the went all the the woman accounts to another bank. According to him businesses in charge of investigating grievances use up all your versatility from the banks as there are zero importance of financial institutions to respond to help you difficulties easily or pay off currency that’s missing. While you are quarantined home, it is perfect timing to complete specific economic “spring-cleaning” and make sure any financial software don’t possess currency resting in them. These software are ideal for sharing money and splitting the bill to own takeout, but it is best that you import those funds into the savings account.

Including, if you’re a card union associate having fun with another borrowing from the bank partnership’s branch (thru shared branching), you’ll need write in title of one’s “home” borrowing from the bank relationship. The whole process of filling out put glides varies depending on exactly what you’re performing. Understanding how to accurately fill out a deposit slip can help to save time and end errors. Deposit slides identify you and offer tips for the financial institution. The two offer speaking to Reuters described it as an easy method you to definitely old boyfriend-President Bankman-Fried can make changes to your organization’s financial record instead flagging the transaction sometimes around or externally. The fresh financial development processes along with unearthed a “back-door” within the FTX’s books that has been made up of “bespoke application.”

Purple, Bluish, & Reddish Postal Money Acquisition (March

We cashed my personal certificate away from deposit (CD) earlier matured, and also the financial energized me a young withdrawal punishment. Therefore my checking account is determined to help you text message me while i found a deposit or has a withdraw that is over $100. We (my personal partner and i also) got a great cashiers seek a protection put for the an apartment. Along with, should your state occurred out of county or having a merchant account that’s lower than 30 days dated, financial institutions may take extra time.

Places managed in different categories of judge control at the same lender will be independently insured. Dumps within the independent branches of a covered bank commonly on their own covered. A covered bank need to display screen a proper FDIC signal at every teller window.